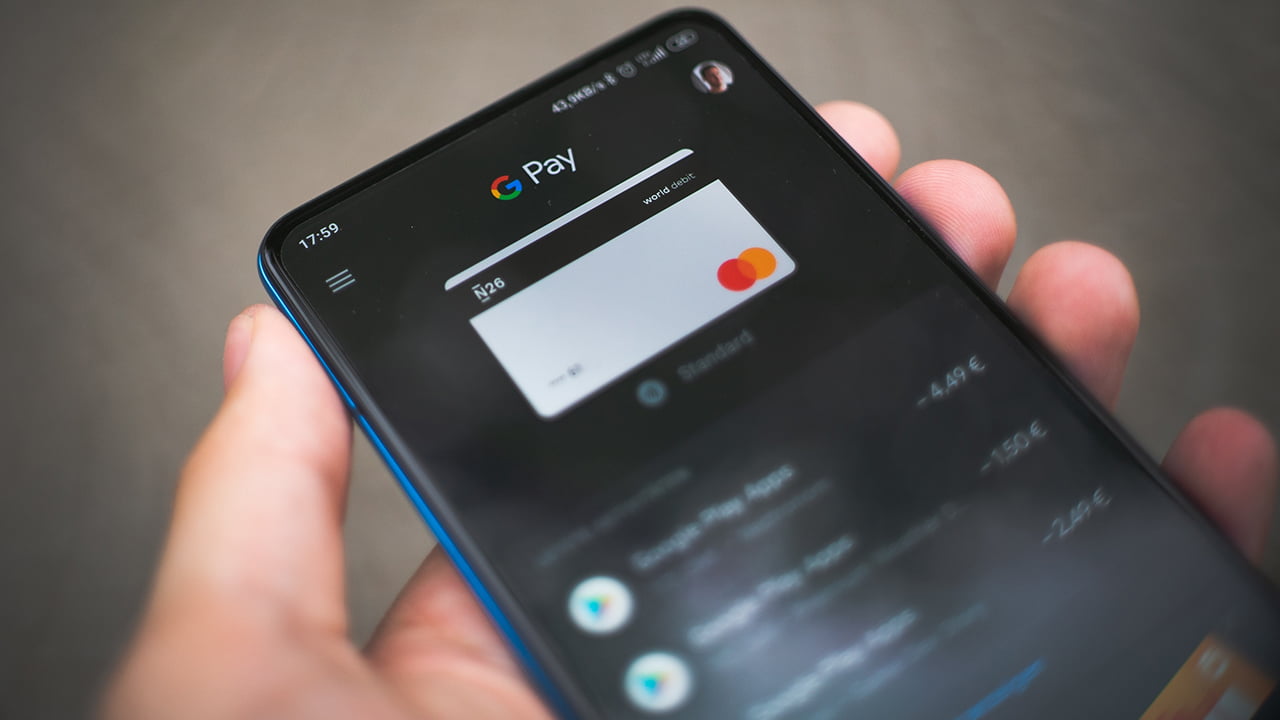

Venmo is getting really popular. More and more users are using this digital wallet to purchase and send money. On the note of making purchases, can you use Venmo on GPay? If so, how to add Venmo to Google Pay?

You can add Venmo to Google Pay by adding Venmo as the payment method. Simply log into your Google Play account, go to “Payment methods,” select “Add a Card,” choose “Debit or Credit Card,” enter the details of your Venmo card, and verify the payment method.

The method discussed above requires you to have a Venmo debit or credit card. You can not add Venmo to your Google Pay account without having the card.

Does Google Accept Venmo?

Google accepts Venmo. You can add your Venmo card to Google Pay and use it to make purchases within Google Play Store, Google Store, and any other services that Google provides.

It works for both Venmo credit and debit cards. And as long as you are within the expenditure limit or have cash on the card, you can make purchases through the payment method.

How to Add Venmo To Your Google Pay Account

As mentioned earlier, the process of adding Venmo to your Google Pay account is pretty straightforward. Check out the steps below:

- Launch the Google Pay app on your Android or iOS device.

- Log into your account.

- Scroll down and tap on “Payment methods.”

- Select “Add a Card.”

- Tap on “Debit or Credit Card.”

- Enter the card’s information.

- Choose a method to verify the payment method.

You can add the Venmo card to your Google account through the web browser. Also, it’s possible to scan the Venmo card’s information with your phone’s camera rather than manually entering it.

How to Add Venmo to Google Pay Without Card

You can not add Venmo to Google Pay without a card. The process requires you to have at least the digital wallet’s debit card. And it’s easy to acquire one. Take a look at the steps that you need to follow to get a Venmo debit card:

- Log into your Venmo account.

- Tap the menu icon that’s in the top left corner.

- Press “Settings.”

- Select “Cards & Banks.”

- Press on the “Get a Card” option.

- Follow the prompts on the screen.

- Wait for the approval of your Venmo debit card.

When Venmo approves the application, your debit card will be sent through the mail. You can use it to purchase wherever the MasterCard is accepted, such as GPay. Also, you can withdraw money from ATM machines.

On that note, if you see a “Get in Line” message after applying for the Venmo Debit Card, it means that you will not get a card at the moment. There’s a large number of people who are trying to get the card, so you have to wait for a while.

Can You Transfer Venmo Money to Google Pay?

You can’t directly transfer the balance of your Venmo account to Google Pay. But you can use the money from your Venmo account through Google. To do so, you have to add Venmo to Google Pay.

Can You Transfer Money From Google Pay to Venmo?

There’s no direct method of transferring money from Google Pay to Venmo. However, you can indirectly send money from Google Pay to Venmo. Here’s how the alternative process works:

- Log into your Google Pay account.

- Transfer the money from Google Pay to your bank.

- Get into your Venmo account.

- Press the add funds option.

- Add the transferred money to your Venmo account.

In this case, you need to make sure that you are using the same bank account for your GPay and Venmo accounts. If there are different bank accounts linked with the accounts, this alternative process will not work.

Bite-sized Summary

See? There are no complex steps on how to add Venmo to Google Pay. All you have to do is get into your Google Pay account and add the Venmo card there. After verification, you can spend your Venmo funds through GPay.

Meet Abid Ahsan, the trusted luminary behind BitsFromByte. With a degree in Computer Science and over a decade of experience, Abid’s authoritative expertise shines through his in-depth guides, meticulous reviews, and timely news coverage on software, operating systems, consumer tech products, phones, PCs, and laptops. His dedication to accuracy, transparency, and unbiased reporting makes it easy for our readers to stay informed in this rapidly evolving tech landscape.